Depreciation formula example

Annual depreciation D Original cost Scrap value Life in year C S n. Prep for Depreciation with Our Practice Tests Study Guides Video Lessons.

Double Declining Balance Depreciation Calculator

This accelerated depreciation method allocates the largest portion of the cost of an asset to the early years of its useful lifetime.

. Following the depreciation expense formula above. You then find the year-one. If you use this method you must enter a fixed.

Depreciation Cost of Bottling Machine Salvage Value Useful Life of Bottling Machine. Divide the difference by years. Calculating Depreciation Using the Units of Production Method.

Units of production depreciation Number of units producedLife in number of units x Cost Salvage value Example. Annual depreciation 2000 500 5 years 1500 5 years 300 According to straight-line depreciation the computer depreciates by 300 every year. Compute depreciation as follows.

In year one you multiply the cost or beginning book value by 50. Depreciation Expense 17000 - 2000 5 3000. Depreciation rate 1 Assets useful life x 100 Once calculated companies use the same rate for each asset in that class.

The formula for finding depreciation using straight line method is given below. Depreciation 108000 8000 5 Depreciation 20000 2 Declining Balance Method For. SLM Annual depreciation expense Original cost of asset - Salvage value of asset.

This rate then goes into various depreciation. Asset cost - salvage valueestimated units over assets life x actual units made. Now you can build a depreciation schedule The depreciation schedule for.

Ad Learn Depreciation Concepts with Our Online Practice Tests Study Guides More. The straight-line method for annual depreciation can be calculated using the formula. Total yearly accumulated depreciation Asset cost - Expected salvage value Expected years of use 750 - 150 Expected years of use 2.

The DDB rate of depreciation is twice the straight-line method. Straight Line Depreciation Example An asset has a cost of I 900 a useful life of N 5 years and an EOL salvage value of S 70. A company buys a press for INR 50000 that can print.

Depreciation Formula Calculate Depreciation Expense

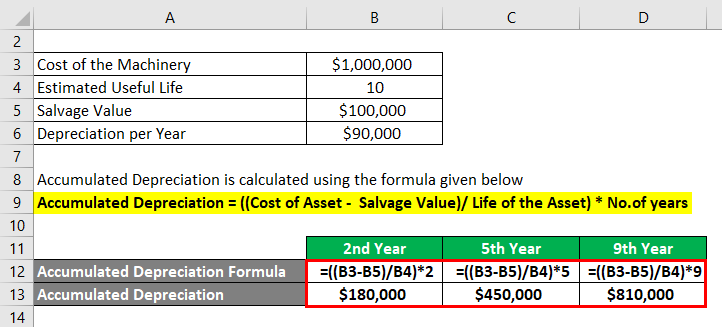

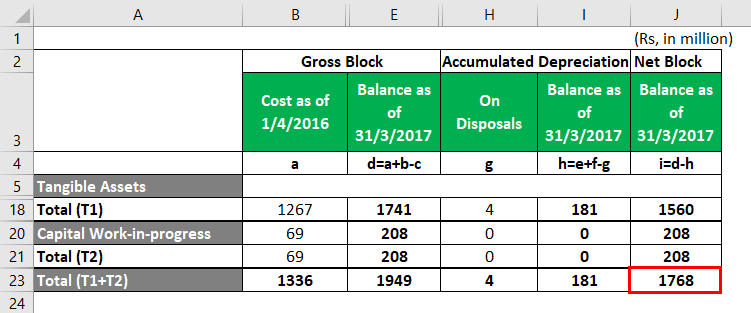

Accumulated Depreciation Formula Calculator With Excel Template

Accumulated Depreciation Formula Calculator With Excel Template

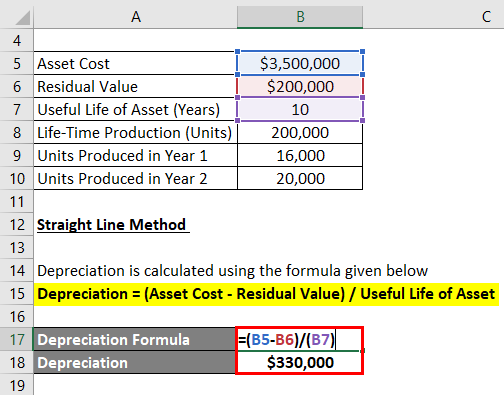

Depreciation Formula Examples With Excel Template

Depreciation Rate Formula Examples How To Calculate

Annual Depreciation Of A New Car Find The Future Value Youtube

Depreciation Formula Examples With Excel Template

Accumulated Depreciation Formula Calculator With Excel Template

Depreciation Rate Formula Examples How To Calculate

Depreciation Calculation

Depreciation Schedule Formula And Calculator

Depreciation Formula Calculate Depreciation Expense

How To Use The Excel Db Function Exceljet

Depreciation Of Fixed Assets Double Entry Bookkeeping

Straight Line Depreciation Formula And Calculator

Depreciation Formula Examples With Excel Template

Depreciation Formula Examples With Excel Template